iban Wallet: A Warning Message

If you decided to start investing your savings in Iban Wallet, you should know that it is easy and quick setting up your account, however, as always, it is better that you are aware of some specific details before you start. This post aims to help you understand all necessary steps required for you to pass the verification process and understand the reasons why Iban Wallet requires your personal information in order to allow you to invest in the platform.

Iban Wallet: Age and Nationality Requirements

You must be over 18 years old and a resident in one of the countries where Iban Wallet operates. Iban Wallet is also available to business clients and entities such as family trusts or societies.

Currently Iban Wallet accepts clients from the following countries: Andorra, Argentina, Australia, Austria, Belgium, Brazil, Canada, Chile, China, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Japan, Lithuania, Luxembourg, Malta, Mexico, Morocco, Netherlands, Norway, Poland, Portugal, Romania, Slovenia, Spain, Sweden, Switzerland, Taiwan, and United States of America.

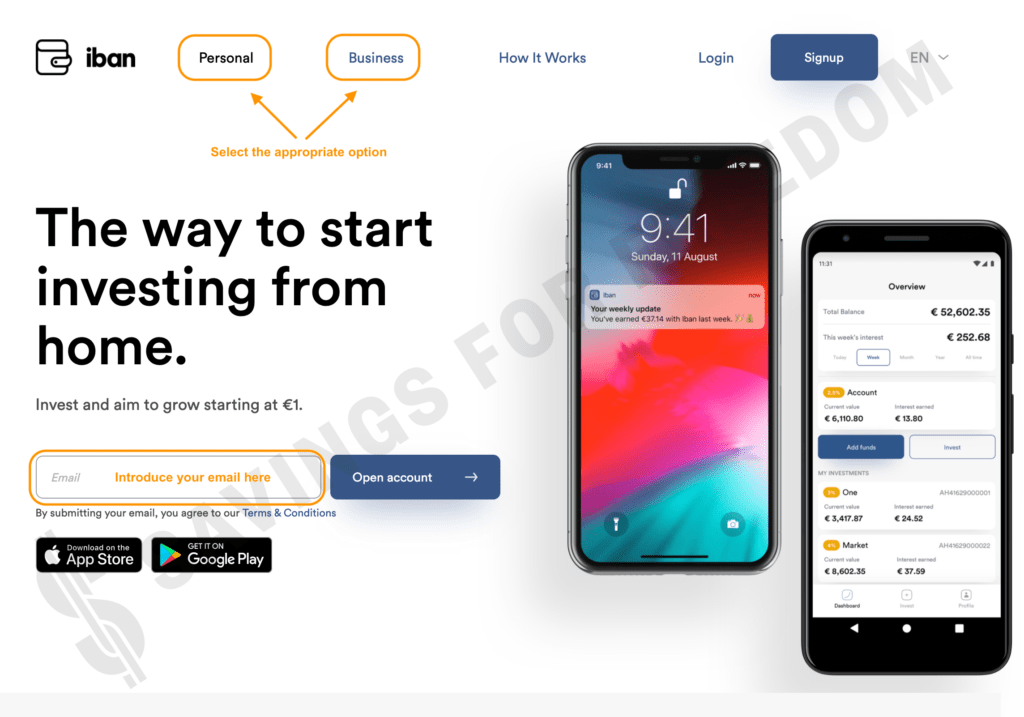

Iban Wallet: Registration Process

Iban Wallet offers a very easy registration experience across all devices (web, android, and iOS). Iban Wallet has country-specific websites with an experience tailored to the user’s nationality and account currency. Customer support is offered in multiple languages and they are aiming to expand to even more.

The first decision you need to make is if you want to open a personal account or a business account. Iban Wallet has a dedicated portal for you to access Iban for Business. And then write your registration email address.

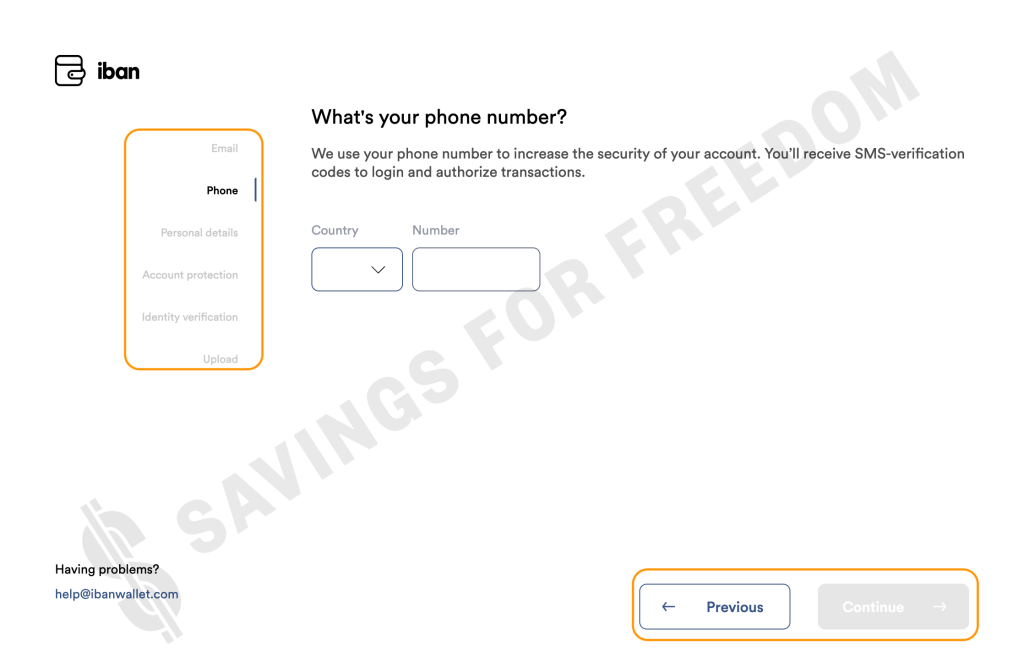

The next steps are all related with personal information collection and identity verification.

Iban Wallet: Identity Verification

As soon as you register your email, and in order to remain compliant with all relevant laws surrounding anti-money laundering and terrorist financing, you need to pass a required customer identification in order to open your account.

First, you need to confirm your mobile number via an SMS code. Next, you will need to fill personal information such as your address. The following step is to upload a copy of your passport, driver’s license, or residency card. A reminder that in order to open your account, your document ID must be from one of the supported countries described above. If it isn’t, you won’t be able to open an account.

In less than 5 minutes you are able to open your Iban Wallet account.

A special note to let you know that Iban Wallet might require additional information from you. This will definitely be the case if you proceed with the deposit of a large sum of money, such as the €50,000 minimum deposit that comes with the Dynamic account. You should expect to upload a proof of address in this event, as well as a proof of source of funds.

Iban Wallet: Adding Funds to your Account

When it comes to depositing funds at Iban Wallet, you can do that via a debit/credit card or through a bank transfer. The latter will go through the SEPA network if you’re based in the Euro Zone, meaning that transfers are both free and fast.

If you’re based outside of Europe, this will need to go through SWIFT. While Iban Wallet will not charge you for making a bank transfer via SWIFT, the sending bank likely will. Both SEPA and SWIFT transfers are usually credited within 24 hours of Iban Wallet receiving the funds.

If your option is to deposit funds using a debit/credit card, then the funds are typically credited in the same instant, after appropriate verification.

Iban Wallet currently allows deposits in EUR, USD, and MXN.

In terms of withdrawing funds out of Iban Wallet, this needs to be sent back to the same bank account that you used to make a deposit. If you deposited funds with a debit/credit card, then you’ll need to link your bank account before a withdrawal can be made and wait for the bank account verification process.

If you use Transferwise, Revolut or N26 Bank, they are perfect options for global investors to manage their funds transfers for Iban Wallet.

iban Wallet: A Warning Message

What to learn more about Iban Wallet?

Iban Wallet Alternatives and Competitors

Do you what to receive updates on new publications? Check SavingsForFreedom on Telegram and WhatsApp, or follow the blog in the links below! Thank you!